W4 withholding calculator

The credit decreases my tax liability to 1000. Use your estimate to change your tax withholding amount on Form W-4.

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Lets say the tax on my income is 8500 and I had 10000 withholding.

. I also get the 7500 Electric Vehicle Credit. 2021 2022 Paycheck and W-4 Check Calculator. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you.

Maximize your refund with TaxActs Refund Booster. 5 How to File Taxes Online in 3 Simple Steps - TurboTax Tax Tip Video. Federal W4 Withholding Status W-4 Cheat Sheet.

2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Check if You have filled out the Latest W4. But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit.

However the withholding on the pension payment is claimed in full in the year of the pension withdrawal year 1. Free Federal and Illinois Paycheck Withholding Calculator. It is important that your tax withholding match your tax liability.

Switch to Oklahoma hourly calculator. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA. Ask your employer if they use an automated system to submit Form W-4.

It will not be affected by your withholding. Calculate your Oklahoma net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Oklahoma paycheck calculator. 1 You Can Make Sure Youre Having Enough Withheld.

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. The Withholding Form. Table of Contents.

The TCJA eliminated the personal. Federal W4 Withholding Status W-4 Cheat Sheet. Withholding and when you must furnish a new Form W-4 see Pub.

3 A Special Note on the Withholding Calculator. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take-home pay. 2 Guide to Using the Withholding Calculator.

My tax for this year is 1000 total. Submit or give Form W-4 to your employer. Instead you fill out Steps 2 3 and 4.

The Form W4 provides your employer with the details on how much federal and in some cases state and local tax should be withheld from your paycheck. Or keep the same amount. Your tax liability is the amount of money that you owe to the government in federal taxes taking into account any tax credits for dependents mortgages or charity.

Heres an example- Lets say the tax on my income is 8500 and I had no withholding. You had no federal income tax liability in 2021 and you expect to have no federal income tax liability in 2022. IRS tax forms.

To change your tax withholding amount. If you would like to use the. 505 Tax Withholding and Estimated Tax.

Taxpayers should arrange to make estimated tax payments for years two and three. Our free W4 calculator allows you to enter your tax information and adjust your paycheck withholding to increase your refund or take-home pay on each paycheck by show you how to fill out your 2020 W 4 Form. Free Federal and Missouri Paycheck Withholding Calculator.

Adjust your W-4 withholdings to get a bigger tax refund or a bigger paycheck. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. 4 How to Change Your Withholding Amount.

Check if You have filled out the Latest W4. Instead you fill out Steps 2 3 and 4. If your withholding doesnt take these into account you could be having too much.

The Form W4 Withholding wizard takes you through each step of completing the Form W4. Estimate your paycheck withholding with our free W-4 Withholding Calculator. You may claim exemption from withholding for 2022 if you meet both of the following conditions.

Now you can easily create a Form W-4 that reflects your planned tax withholding amount. Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return.

Tax Withheld Calculator Hotsell 54 Off Www Wtashows Com

Irs Improves Online Tax Withholding Calculator

Tax Withheld Calculator Flash Sales 57 Off Www Wtashows Com

Irs Releases New 2018 Withholding Tables To Reflect Tax Law Changes

How To Fill Out A W4 2022 W4 Guide Gusto

How To Calculate 2019 Federal Income Withhold Manually

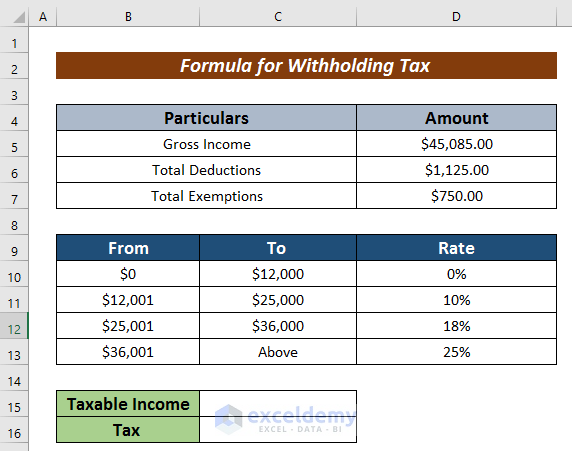

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Federal And State W 4 Rules

Tax Witheld Calc Online 56 Off Www Wtashows Com

Calculation Of Federal Employment Taxes Payroll Services

Tax Withheld Calculator Shop 57 Off Www Wtashows Com

Tax Withheld Calculator Flash Sales 57 Off Www Wtashows Com

Excel Formula Income Tax Bracket Calculation Exceljet

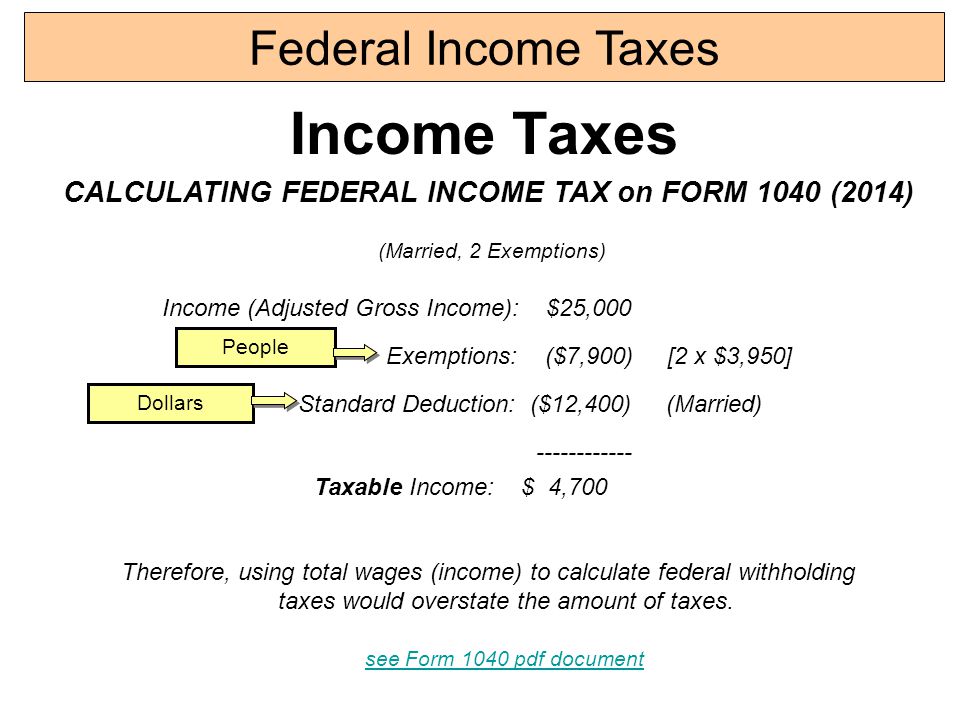

How To Calculate Federal Income Tax

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies